Excitement About Estate Planning Attorney

Excitement About Estate Planning Attorney

Blog Article

Get This Report about Estate Planning Attorney

Table of ContentsEstate Planning Attorney Things To Know Before You Get ThisEstate Planning Attorney - QuestionsEstate Planning Attorney Can Be Fun For AnyoneHow Estate Planning Attorney can Save You Time, Stress, and Money.

Your lawyer will certainly also aid you make your papers authorities, arranging for witnesses and notary public signatures as needed, so you do not have to stress regarding attempting to do that last action on your very own - Estate Planning Attorney. Last, however not the very least, there is beneficial assurance in establishing a relationship with an estate preparation attorney that can be there for you later onPut simply, estate preparation attorneys offer value in numerous ways, much beyond just supplying you with published wills, trusts, or other estate planning files. If you have questions concerning the procedure and wish to discover more, contact our office today.

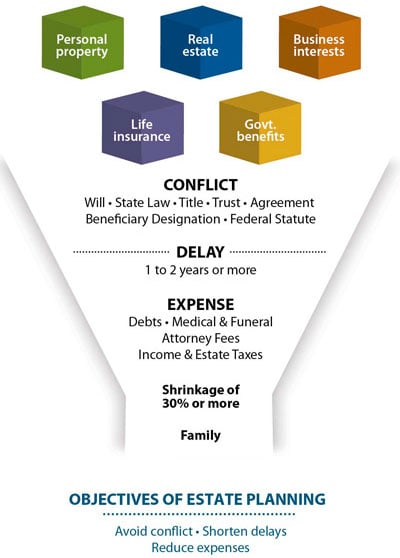

An estate preparation lawyer assists you formalize end-of-life choices and legal papers. They can set up wills, establish trust funds, develop healthcare directives, develop power of attorney, develop sequence plans, and extra, according to your dreams. Dealing with an estate planning attorney to complete and manage this legal documents can assist you in the following eight areas: Estate intending attorneys are professionals in your state's trust, probate, and tax regulations.

If you do not have a will, the state can decide just how to separate your properties amongst your successors, which might not be according to your wishes. An estate planning attorney can assist organize all your lawful records and disperse your assets as you desire, possibly avoiding probate.

The Buzz on Estate Planning Attorney

When a customer dies, an estate strategy would dictate the dispersal of assets per the deceased's directions. Estate Planning Attorney. Without an estate strategy, these decisions might be left to the following of kin or the state. Responsibilities of estate planners include: Creating a last will and testament Establishing trust fund accounts Calling an executor and power of lawyers Identifying all recipients Naming a guardian for minor youngsters Paying all financial obligations and lessening all tax obligations and lawful costs Crafting instructions for passing your worths Developing choices for funeral arrangements Settling instructions for treatment if you end up being ill and are not able to choose Getting life insurance coverage, special needs earnings insurance policy, and lasting care insurance A great estate plan must be updated frequently as customers' financial circumstances, individual motivations, and federal and state legislations all evolve

As with any career, there are attributes and skills that can help you accomplish these goals as you deal with your customers in an estate planner duty. An estate planning profession can be appropriate for you if you possess the following characteristics: Being an estate coordinator suggests thinking in the long term.

Some Known Details About Estate Planning Attorney

You should assist your client expect his/her end of life and what will happen postmortem, while at the very same time not house on morbid thoughts or emotions. Some customers might become bitter or anxious when considering death and it could fall to you to aid them with it.

In the event of death, you may be anticipated to have numerous discussions and ventures with enduring family members regarding the estate strategy. In order to succeed as an estate planner, you might need to walk a great line of being a shoulder to lean on and the individual trusted to communicate estate planning matters in a prompt and specialist fashion.

tax code transformed thousands of times in the ten years between 2001 and 2012. Expect that it has actually been altered additionally since after that. Depending on your client's economic income bracket, which may advance toward end-of-life, you as an estate organizer will certainly need to maintain your customer's properties completely lawful conformity with any kind of regional, government, or worldwide tax legislations.

Examine This Report on Estate Planning Attorney

Acquiring this accreditation from organizations like the National Institute of Qualified Estate Planners, Inc. can Check This Out be a strong differentiator. Belonging to these expert groups can confirm your abilities, making you much more attractive in the eyes of a prospective customer. Along with the emotional reward of aiding customers with end-of-life planning, estate organizers delight in the advantages of a steady income.

Estate preparation is an intelligent point to do regardless of your existing health and economic status. The very first important thing is to work with an estate planning lawyer to aid you with it.

The percentage of next people who don't understand just how to get a will has actually increased from 4% to 7.6% considering that 2017. A seasoned attorney understands what information to consist of in the will, including your recipients and unique considerations. A will shields your family from loss as a result of immaturity or incompetency. It additionally provides the swiftest and most efficient technique to move your properties to your recipients.

Report this page